52

@ U S T . H K

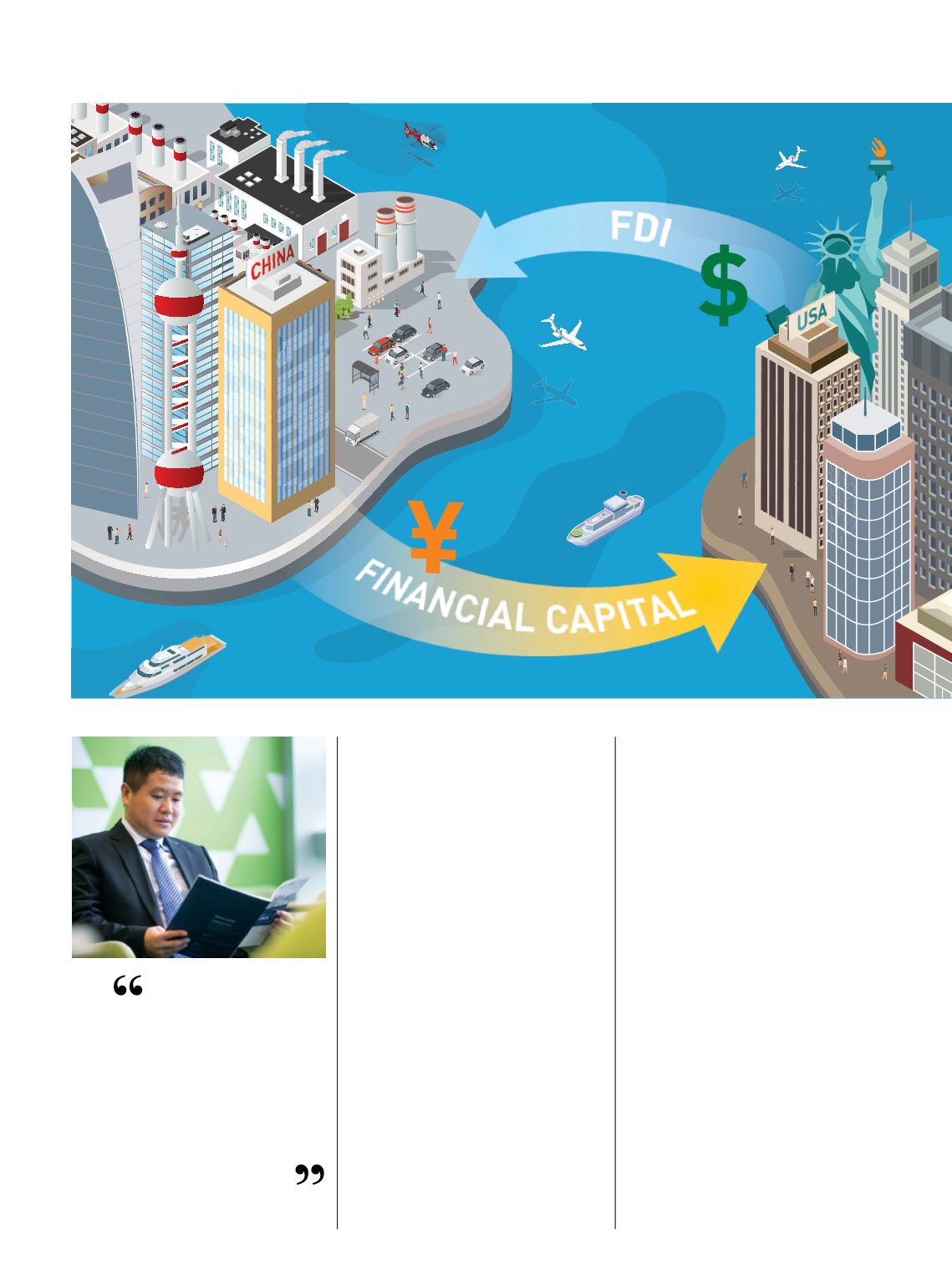

The emergence of China as a major

source of capital for developed countries

is a phenomenon that has caught

economists and politcal leaders by

surprise. Research at HKUST offers

novel perspectives on the flows of

capital in and out of China and its

massive trade imbalance with the West,

with economist Prof Pengfei Wang

and his collaborators becoming the first

to quantify this data and use it to

develop a new theory to explain the

dynamics involved.

Classic economic theory has long

suggested that capital normally flows

from developed countries, where it is

abundant, to the developing. However,

economists have been perplexed as

to why the reverse now appears to be

true. This is particularly the case for

China, which by the end of March 2017

was holding US$3 trillion in foreign

reserves, mostly US government bonds.

Prof Wang explained that this is an

outcome of China’s immature financial

system. Due to the underdeveloped

banking-credit-financial system, house-

holds have limited investment options.

At the same time, households and

firms have borrowing constraints. This

gap creates financial frictions: house-

holds save excessively to self-insure

against unpredictable shocks. However,

their huge financial capital cannot be

effectively channeled to firms.

Prof Wang observed that financial

capital in China yields a lower rate of

return compared with the US. This

drives domestic household savings to

flow to the US for higher returns,

despite government-imposed currency

restrictions, and the rise of informal

financing platforms. He also noted that

Analyses are difficult

if we assume people

are irrational

because irrationality

has limited use in

making predictions

PROF PENGFEI WANG

Professor of Economics

INS AND OUTS

OF CAPITAL

FLOWS AND

ASSET BUBBLES